Ruler of States Federal of State Government Department Local Authority Inland Clearance Depot Duty Free Shop. The following person are exempted from Sales Tax.

The amendments are in respect of Item 3 of Schedule B and include.

. Security Policy Site Map. Upstream operator will be given an exemption from sales tax subject to prescribed conditions as stated. Liability of directors etc.

Jalan Rakyat Kuala Lumpur Sentral PO. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business.

FREQUENTLY ASKED QUESTIONS FAQ - Sales Tax 2018 SALES TAX 1. 02021000 00 - Carcasses and half-carcasses. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime.

Following the announcement of the re-introduction of SST the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge before SST commence. I shall focus on certain Operations that were disputed as to whether these qualified for Exemption under this Order either because of the nature of the Operation. Schedule AOld Module Sign Up.

In the service tax no input exemption mechanism is. The service tax will stand at 6 and it would be levied on. Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used.

Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on. Such approved traders and manufacturers are granted full sales tax exemption on their importation or. A 2072018 Sales Tax Exemption from Registration Order 2018 - PU.

Section 61A STA 2018 Exemption from payment of sales tax on taxable goods imported transported or purchased from registered manufacturer. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. Sales tax is not.

Recovery of sales tax before payable from persons about to leave Malaysia 31. Imposition of Sales Tax 4. On taxable goods manufactured in Malaysia by a taxable person and sold by him including used or.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Power of Minister to exempt and refund 36. The abovementioned Exemption Order refers to the Sales Tax Persons Exempted from Payment of Tax Order 2018.

Class of person eg. SCOPE OF SALES TAX 3. Sales tax is a single-stage tax charged and levied.

Please click on the above header link for a copy of the said Amendment Order at the official portal of the Federal Legislation. Act 806 English Sales Tax Act 2018 Regulations Sales Tax Regulations 2018. Recovery of sales tax etc from persons about to leave Malaysia.

A complete list of goods exempted from sales tax can be found in the Sales Tax Goods Exempted From Tax Order 2018. Malaysia Service Tax 2018. Trader of taxable goods.

This tax is not required for imported or exported services. On taxable goods imported into Malaysia. Exemption Order upon re-importation of the pallets.

Malaysia Sales Service Tax SST. Box 10192 50706 Kuala Lumpur Malaysia Tel. Person Exempted From Sales Tax Order 2018 Exemption From Registration Order 2018 Imposition of Tax In Respect Of Designated Areas Order.

This Policy provides clarity on when exemption can apply or othemise specifically for pallets. 4 The Minister may by order and subject to conditions as he deems fit. Imported into Malaysia by any person Imposition Of Sales Tax Subsection 81 STA 2018.

LAWS OF MALAYSIA STATES LAW. Part VI EXEMPTION REFUND DRAWBACK AND REMISSION 35. 5 Heading 1 Subheading 2 Description 3 02013000 00 - Boneless 0202 Meat of bovine animals frozen.

Over the course of years following the enforcement of that Order the Dept made several decisions that could have a bearing on Companies engaged in similar activities now under the Sales Tax Act 2018. Order 2018 - PU. The Service tax is also a single-stage tax with a rate of 6.

The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so. A 2082018 Sales Tax Total Sale Value of Taxable Goods Order 2018 - PU. Sales tax is a tax charged and levied - on taxable goods manufactured in Malaysia by a taxable person and sold used or disposed by him.

This Act may be cited as the Sales Tax Act 2018. Manufacturers of such goods would not need to be registered for sales tax to avail of the exemption. What is sales tax.

The Sales Tax Persons Exempted from Payment of Tax Amendment No 3 Order 2021 has been gazetted and comes into operation on 6 August 2021. Note that this is the first Policy issued by RMCD on Sales Tax matters.

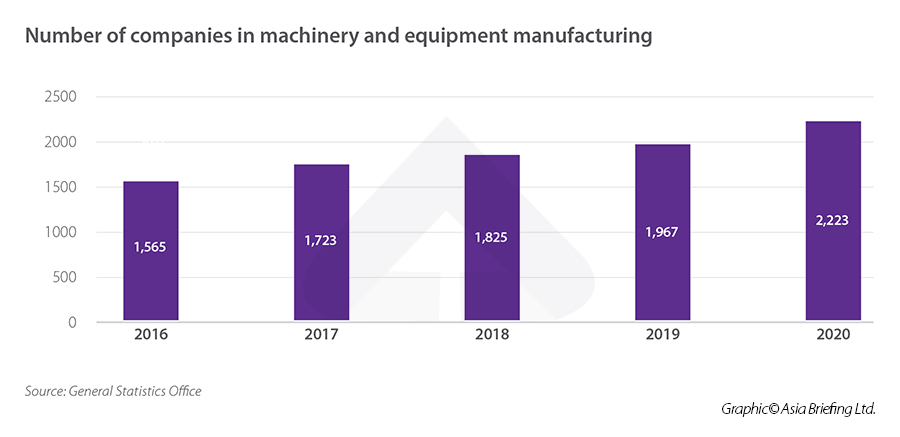

Vietnam S Machinery And Equipment Industry Market Trends Key Players

1 Nov 2018 Budgeting Inheritance Tax Finance

Ronnie Nissan On Twitter Update Tax Exemption For Our Nissan Vehicles Including Rebates Rewards Very Low Price Nissan Almera Nissan Serena Nissan X Trail Nissan Navara Https T Co Bee0ybbtah

Sales Tax 2018 Guide On Sales Tax Exemption Under Item 57 Schedule A Sales Tax Persons Exempted From Payment Of Tax Order Pdf Free Download

Ohio Adopts South Dakota Style Economic Nexus

Merger Prospectus Communication 425

Sheldon Harding Owner Www Theresponsivecpa Com Linkedin

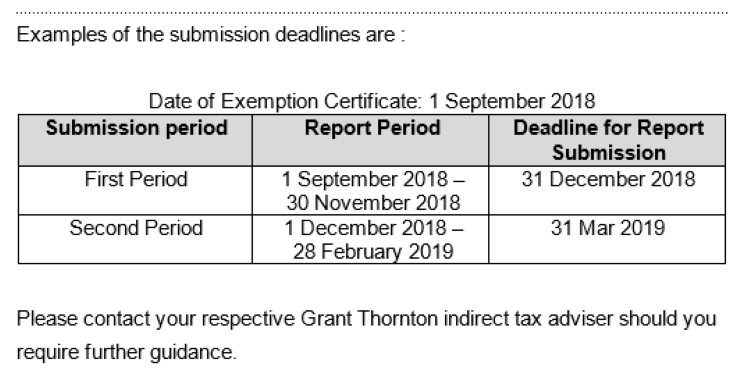

Tax Alert Grant Thornton Malaysia

Sales Tax 2018 Guide On Sales Tax Exemption Under Item 57 Schedule A Sales Tax Persons Exempted From Payment Of Tax Order Pdf Free Download

1 Nov 2018 Budgeting Inheritance Tax Finance

Sales Tax 2018 Guide On Sales Tax Exemption Under Item 57 Schedule A Sales Tax Persons Exempted From Payment Of Tax Order Pdf Free Download

Service Tax Exemption On Eligible Labuan Incorporated Entities